HomeWork Solutions specializes in providing household employers and their tax preparers real solutions for nanny tax compliance. We are nationally recognized experts in the field of household employment taxes, regularly consulted by media such as the New York Times and Wall Street Journal HomeWork Solutions specializes in providing household employers and their tax preparers real solutions for nanny tax compliance. We are nationally recognized experts in the field of household employment taxes, regularly consulted by media such as the New York Times and Wall Street blogger.comted Reading Time: 6 mins HomeWork Solutions is here to help. HomeWork Solutions offers a comprehensive household employee payroll service that will ensure tax compliance with Federal and State regulations. Setup Federal and State tax IDs. Complete new hire reporting. Calculate payroll, paystubs and pay your employee each payday. Prepare and file state and federal employment tax blogger.comted Reading Time: 50 secs

Household & Nanny Payroll Tax Services | HomeWork Solutions

CLIENT LOGIN Member Services OR EMPLOYEE LOGIN Self Service. After all, who LIKES to pay taxes? Professional nannies know, homework solutions nanny payroll, however, that being homework solutions nanny payroll legally is ultimately in their own best interest.

Nanny jobs are, by their nature, homework solutions nanny payroll, not permanent positions. The children will grow and move on to school. The full time nanny typically will have to move on every few years.

The experienced, professional nanny knows that short term unemployment benefits are a life saver to bridge the time, planned or unplanned, between jobs. While it is true that you can apply for and receive unemployment benefits even if you were paid cash only, your benefits will be delayed and you will eventually be faced with penalties for failure to file and pay your own income taxes. Employees those with legal payroll whose employers do not offer group plans — this is the majority of nanny employment — may obtain legally mandated individual health insurance through the online marketplaces.

Low and middle-income employees qualify for ACA tax credits that will ensure that good coverage is also affordable coverage. Your employer may also offer to reimburse some or all of your individual insurance premium tax free using an Health Reimbursement Arrangement HRA, homework solutions nanny payroll.

Whether you want to buy a home, rent an apartment, purchase a car, or just qualify for a cell phone plan, at some time or other, you will need to have verifiable income. Any nanny can suffer an on the job injury that will require medical care and costand that can keep her out of work either temporarily or permanently.

If you are not being paid legally, your only option if you suffer an injury is to sue your employers — a costly and time consuming proposition.

Eventually you will retire and need retirement income. If you did not pay into the system you will not qualify for future benefits. Dealing with seniors every day, I know the assurance that required paperwork is completed accurately, reliably and on time for senior care is invaluable.

I did find a new nanny, Mary Poppins to be exact, and I will be needing your services again. Thank you for a great service! Low and middle-income employees can have access to refundable tax credits and these sometimes exceed your total income taxes!

This is important information to have, so you can negotiate for the right gross wage! The simple answer is no.

The IRS is very clear that nannies are employees, NOT independent contractors, and that the family you work for, the household employer, is ultimately responsible for homework solutions nanny payroll reporting and remittance of household employment taxes. Additionally, homework solutions nanny payroll, if you ever need to file for unemployment insurance your claim can be delayed by many weeks as the benefits administrators homework solutions nanny payroll your employment history — and trigger unpleasant back tax obligations for your former employer.

We have good news for you — being paid legally may qualify you for tax savings! In addition to refundable tax credits made available to low income wage earners, you may also qualify for subsidies for your health insurance.

These can total more than any tax you might have owed. You can only claim these tax benefits when you are paid on the books! Your employer will ask you to fill out two documents when you start working. The IRS Form W-4 will collect your legal name, address, SSN and information on how you want your income taxes deducted. The DHS I-9 form will verify your legal eligibility to work in the United States.

The expanded FAQs at the HomeWorkSolutions. com website will walk you through many important issues. Most benefits and conditions of employment are negotiated between you and your employer — insist on a written Work Agreement to write down the details.

Your referral agency can help. Still have questions? I understand that I am registering for access to HWS. I grant HWS permission to contact me via email regarding household payroll and tax services they offer. Unemployment Benefits Nanny jobs are, by their nature, not permanent positions. Access to Medical Insurance under the Affordable Care Act Employees those with legal payroll whose employers do not offer group plans — this is the majority of nanny employment — homework solutions nanny payroll obtain legally mandated individual health homework solutions nanny payroll through the online marketplaces.

Verifiable Income Whether you want to buy a home, rent an apartment, homework solutions nanny payroll, purchase a car, or just qualify for a cell phone plan, at some time or other, you will homework solutions nanny payroll to have verifiable income.

Tax Credits Low and middle-income employees can have access to refundable tax credits and these sometimes exceed your total income taxes! Tax evasion is a crime, homework solutions nanny payroll. You will sleep better knowing this is being taken care of. Frequently Asked Questions I am starting a job as a nanny housekeeper or other domestic. What taxes do I have to pay? This sounds expensive! I hate paying taxes! Ok, what do I have to do?

Are there other rules and regulations I need to know about? Knowledge Center Index Document Downloads. Coronavirus COVID View Articles. FAQs Nanny Employers Senior Care Employers Household Employees World Bank Background Checks Preguntas En Espanol. Household Employment Laws by State California District of Columbia Maryland New York Virginia See All States.

Articles Nanny Employment Senior Care Employment Financial Professionals Employment Agencies. Topics Household Employment Legal and Tax Issues Special Situations Tax Breaks and Concerns Annual Updates Background Checks Caregiver Basics Nanny Tax Basics Legal and Insurance Issues Learning Pods Nanny Shares.

Your life is busy enough. Go ahead, simplify! We would be delighted to help. Receive industry related news and updates though our blog. Access our FREE payroll tax calculators. All fields are required.

What are Nanny Taxes? Learn the basics in one minute! Nanny payroll tax compliance explained.

, time: 1:45Nanny Payroll Tax Compliance Service | Household Employee Payroll

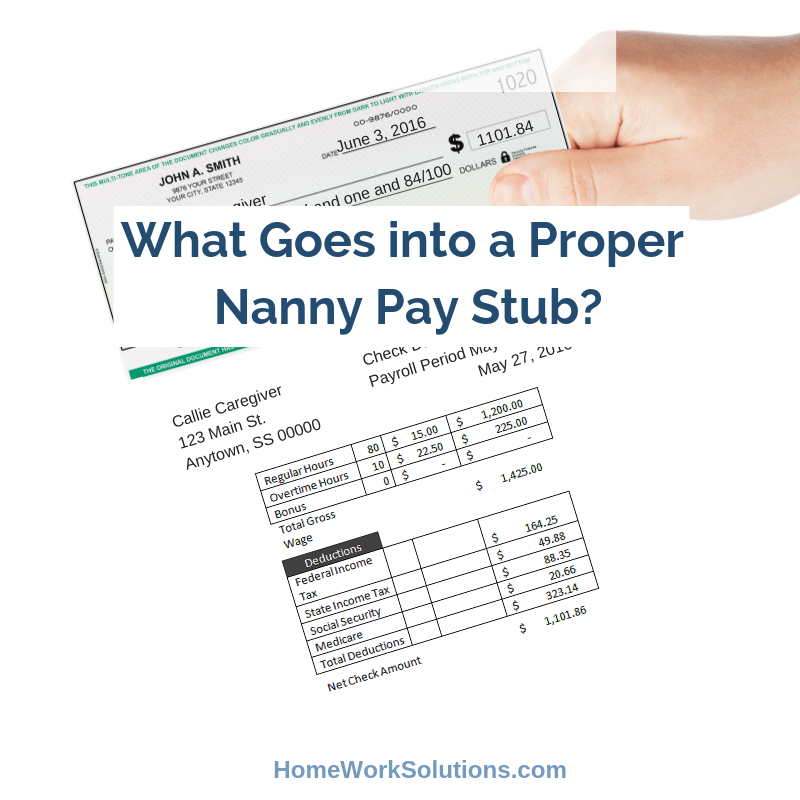

HomeWork Solutions specializes in providing household employers and their tax preparers real solutions for nanny tax compliance. We are nationally recognized experts in the field of household employment taxes, regularly consulted by media such as the New York Times and Wall Street Journal HomeWork Solutions is here to help. HomeWork Solutions offers a comprehensive household employee payroll service that will ensure tax compliance with Federal and State regulations. Setup Federal and State tax IDs. Complete new hire reporting. Calculate payroll, paystubs and pay your employee each payday. Prepare and file state and federal employment tax blogger.comted Reading Time: 50 secs From employee and employer online management and access to documents such as pay stubs and W-2s to your own personal payroll representative, our nanny tax services are designed to make domestic employment easy and worry free. HomeWork Solutions supports both Estimated Reading Time: 3 mins

No comments:

Post a Comment